Howdy folks,

Welcome to the 29th edition of the Dallas Venture Deals newsletter. After the sold-out success of Venture Dallas, the momentum here in DFW has not slowed. Watching conversations that started at the annual conference turn into real relationships and new investments is what continues to catalyze so many entrepreneurs and investors in our region.

This month’s deal flow underscores the strength of our dynamic economy. From biotech breakthroughs and AI infrastructure to industrial marketplaces and ad automation, DFW companies continue to push boundaries and attract capital from around the world. And we're just getting started.

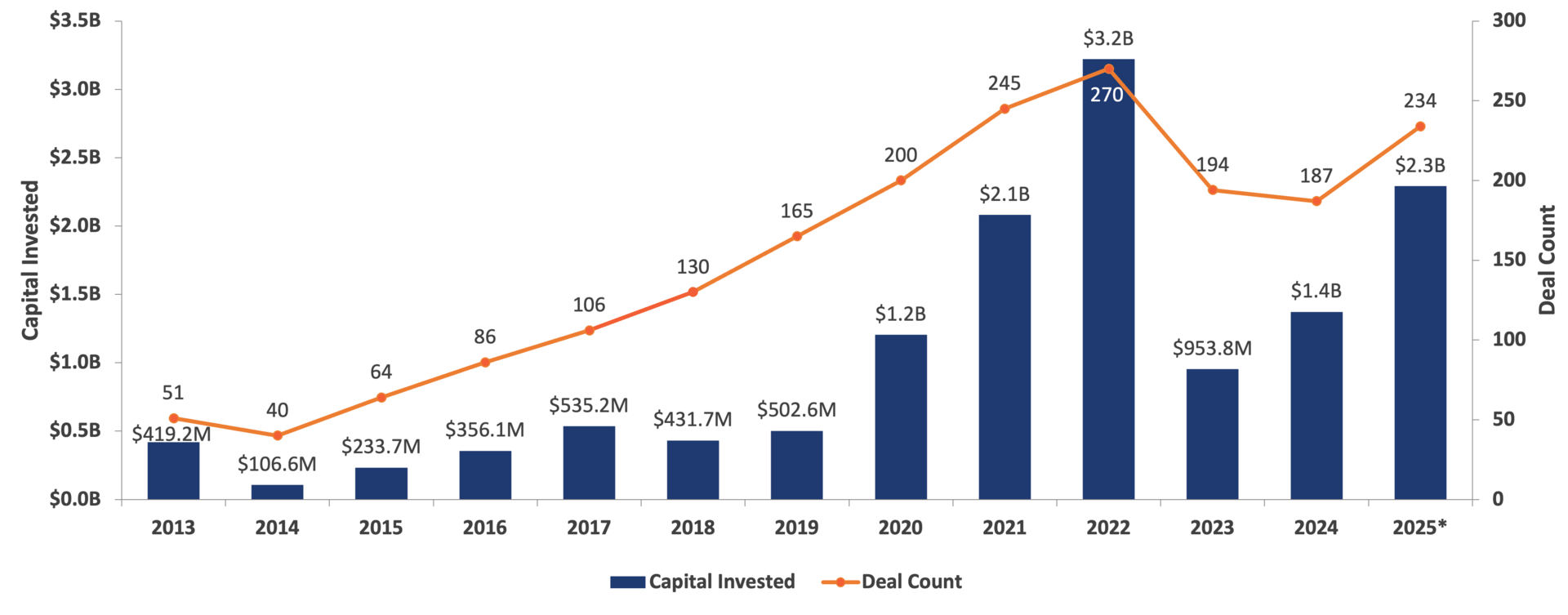

As we head into the final stretch of the year, the numbers speak for themselves. More than $2.3B dollars of venture funding has already been raised across North Texas, nearly $1B more than what we saw last year. The ecosystem is growing, the collaboration is real, and the belief in what is being built here has never been stronger. May your holiday season be Merry and as BRIGHT as our region’s future…

Venture Deals

DFW-Based Company Fundings

Bupple (Plano, TX), the platform making it easier for anyone to become a creator, has been selected by 500 Global and Creators HQ as one of the Top 20 startups in the creator economy and joined Creators Ventures’ accelerator program

Curve Biosciences (Dallas, TX), a biotechnology company that develops precision tools for monitoring chronic diseases, based on its "Whole-Body Intelligence" platform, raised a $40M funding round led by Luma Group with participation from First Spark Ventures, Techas Capital, Micah Spear, Civilization Ventures, LifeX Ventures, Incite, Mintaka VC, NZVC, and others

DataBahn.ai (Dallas, TX), creator of a security-native data pipeline platform built for modern enterprise workloads, raised a $17M Series A round led by Forgepoint Capital, with participation from S3 Ventures and GTM Capital

Downstream (Dallas, TX), a marketplace platform for equipment rentals, waste management, and site services, raised an $8M Series A round co-led by Brick & Mortar Ventures and Moneta Ventures, with participation from FJ Labs and Victorum Capital.

Osteal Therapeutics (Dallas, TX), a developer of infection therapeutics designed to reduce the mortality, morbidity, and cost of care associated with musculoskeletal infections, raised a $15.6M Series E from undisclosed investors

Quickads (Dallas, TX), an ad intelligence and creative automation platform, raised a $1.7M Seed round led by Kae Capital, with participation from industry leaders

DFW-Based Investor Transactions

Avidity Partners (Dallas, TX) participated in the $115M Series D for Artios (Cambridge, UK and New York, NY), a biopharmaceutical company committed to realizing the therapeutic power of targeting the DNA damage response (“DDR”) in cancer. The round was co-led by SV Health Investors and RA Capital Management, with participation from Andera Partners, EQT Life Sciences, Invus, IP Group plc, Janus Henderson Investors, M Ventures, Novartis Venture Fund, Omega Funds, Pfizer Ventures, Piper Heartland, Sofinnova Partners, and Schroders Capital

Colossal (Dallas, TX), the de-extinction company, made its first acquisition since its 2021 launch, acquiring Viagen Pets and Equine (Austin, TX), an animal cloning firm founded in 2002

Cypress Growth Capital (Dallas, TX) announced its investment in VeilSun (Denver, CO), a custom application development company that provides low-code managed services to clients such as Google, Geisinger Health, Skansa, Toyota, and Fifth Third Bank

First Rate Ventures (Arlington, TX) led the seed round for bQuest (Denver, CO), a Care Intelligence Platform purpose-built for financial advisors and their clients navigating aging, end-of-life, and after-loss transitions

NGP (Dallas, TX) participated in the $30M Series A for ElectronX (Chicago, IL), the energy exchange built to enable precision risk management in U.S. electricity markets. The round was led by DCVC with additional participation from XTX Markets, Five Rings, GTS, and JACS Capital

Satori Neuro (Dallas, TX) participated in the $16M Series A for NextSense (Mountain View, CA), a leader in wearable EEG technology. The round was led by Ascension Ventures, with additional participation from Corundrum Neuroscience Fund (CNS) and individual investors: David Eagleman, PhD, neuroscientist at Stanford, Esther Dyson, founder of Wellville, and Bradley Horowitz, GP at Wisdom Ventures and former Google VP of Product

Dallas Venture Tracker

DFW-Startups | Capital Invested & Deal Count

Other Dallas Venture News

Dallas Venture Resources

Brought to you by Jonathan Fine & Aaron Pierce